FAQ Employers – Kanz PaydayNow Earned Wage Access Service by Xanderia Services

- What is Earned Wage Access (EWA)?

Earned Wage Access is a concept that allows employees to access a portion of their earned wages before the traditional payday of the employer’s company. It provides employees with greater control over their finances, enabling them to cover unexpected expenses or meet urgent financial needs.

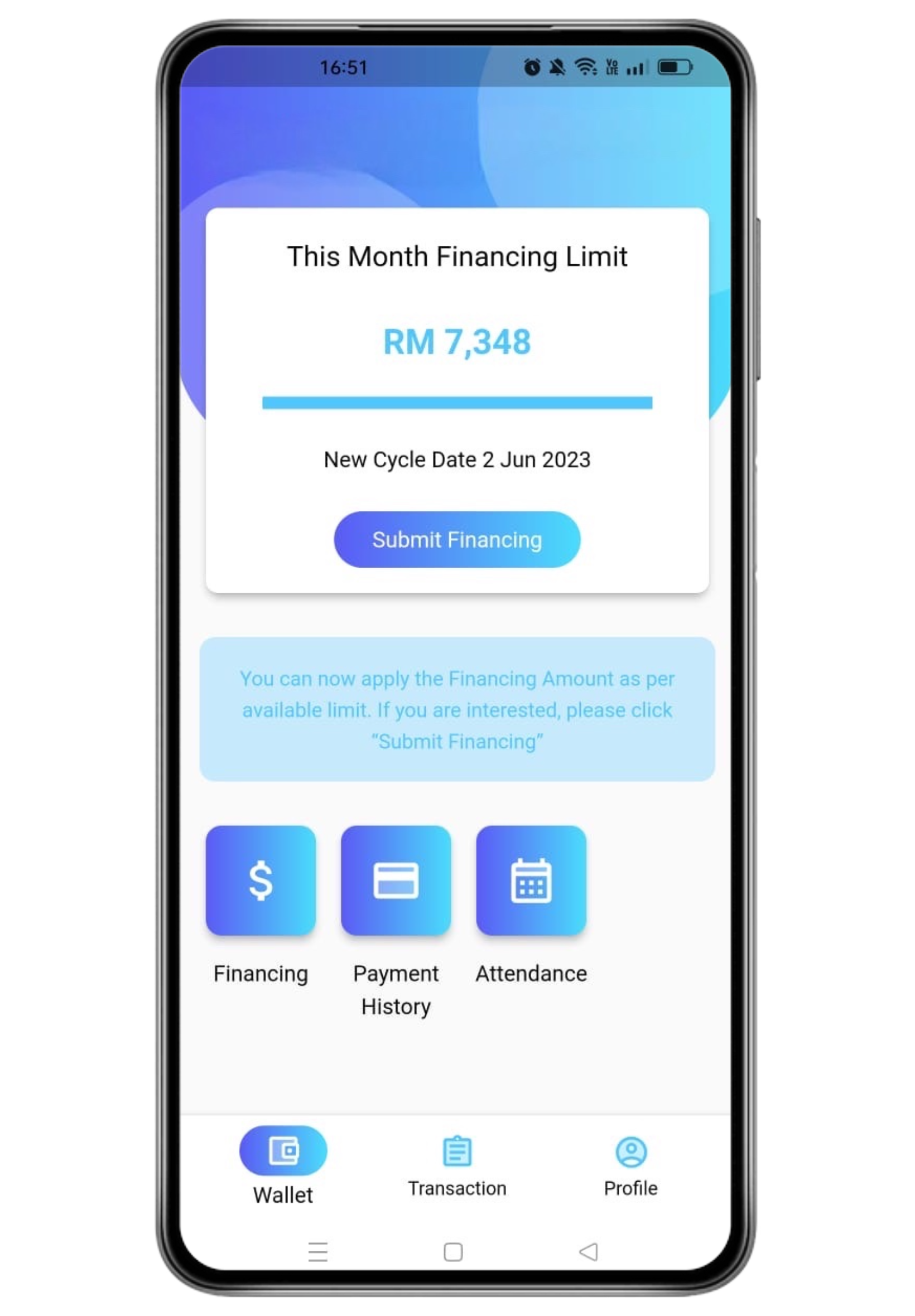

- What is Kanz PaydayNow?

Kanz PaydayNow is a mobile app (currently available for Android only) that offers an Earned Wage Access service. It revolutionizes the way companies support their employees’ financial well-being by providing them with the flexibility to access their earned wages when needed.

- How does Kanz PaydayNow work?

Employees can apply for an upfront salary through the Kanz PaydayNow app, based on the days they have worked. Once approved by HR, Xanderia ensures the disbursement of the requested amount is completed within 24 hours. This feature allows employees to manage their finances efficiently and address immediate financial needs.

- Is there a cost for employers to integrate Kanz PaydayNow?

No, there are no costs associated with integrating Kanz PaydayNow into existing payroll systems. Xanderia provides free integration, enabling employers to seamlessly adopt the service without any additional expenses.

- How does the attendance system work?

Kanz PaydayNow comes with an automated attendance system. Employees can clock in through the app, which tracks their location only when necessary (at the office/working location). Attendance records require HR approval.

- Is Kanz PaydayNow Shariah compliant?

Yes, Kanz PaydayNow is fully Shariah compliant. Employers adhering to Islamic principles can benefit from this innovative solution without compromising their values.

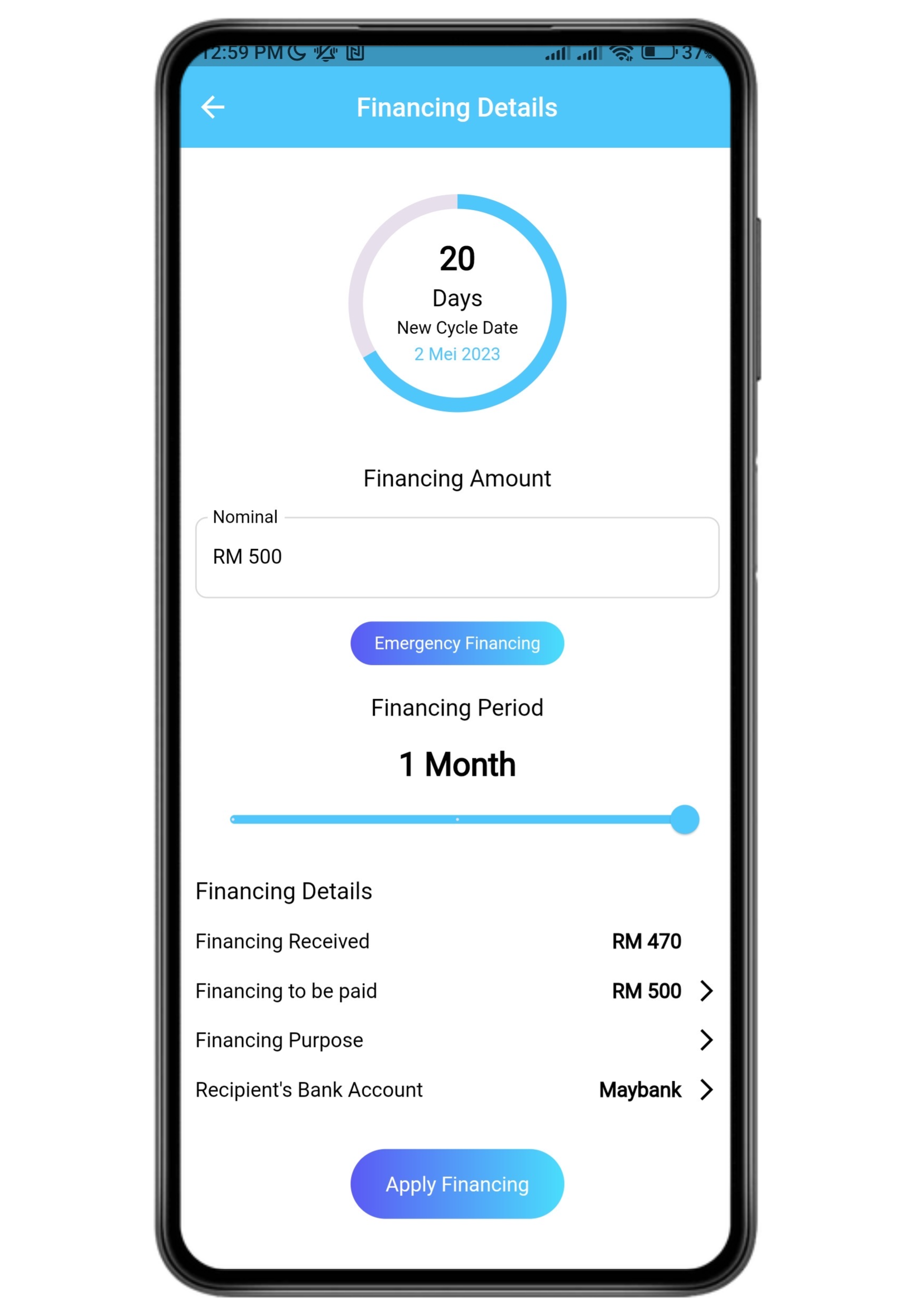

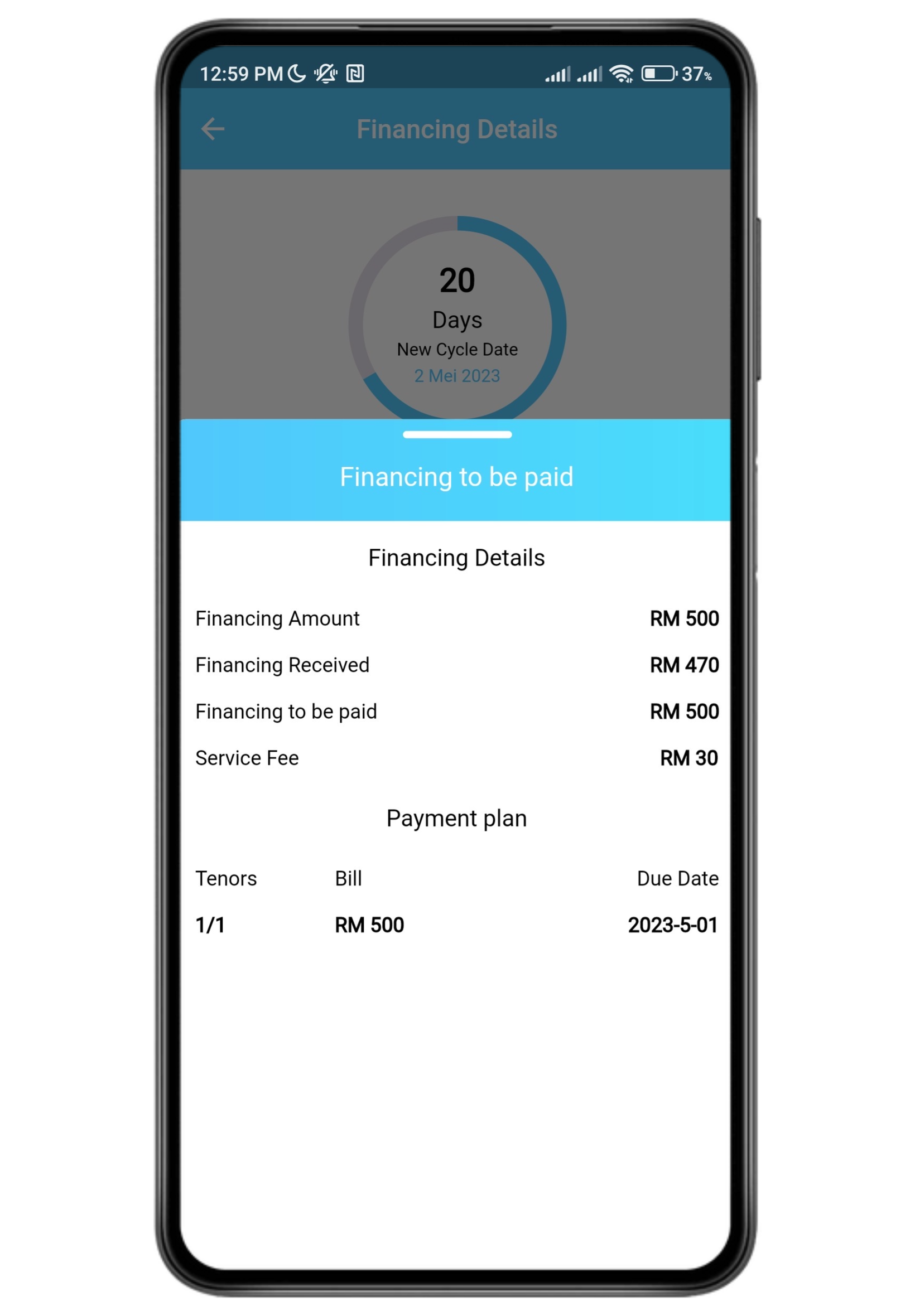

- What is the service fee for employees using Kanz PaydayNow?

Employees who apply for salary advancement through Kanz PaydayNow are charged a service fee of 6% based on the requested amount.

- How does Kanz PaydayNow benefit employers?

Kanz PaydayNow enhances employee productivity, attracts top talent, fosters a positive company culture, ensures smooth cash flow, and improves employee retention and engagement.

- How does the Kanz PaydayNow registration process work?

The registration process involves signing a Non-Disclosure Agreement (NDA), app demonstration, filling out an application form, screening, and finalizing an agreement along with employee consent forms, an Employee Nominee form, and a Company Guarantee form.

- How does an employee/user access the Kanz PaydayNow app?

Employees are provided with login credentials and can access the app by logging in and inputting an OTP code sent to their email for verification.

- How does the employee attendance feature work?

Employees can log in to the app, click on the attendance feature, check-in, follow the attendance instructions, and await HR verification. Once verified, it counts as one working day.

- How does the Earned Wage Access request process work?

Users submit an Earned Wage Access request through the app, which notifies HR. After HR approval, Xanderia disburses the requested amount, which is then transferred to the user’s account.

- What are the minimum and maximum amounts that employees can request through Kanz PaydayNow?

Employees can request a minimum amount per transaction of RM 500, which represents their earned wages accumulated over the working days. This ensures that employees have earned more than RM 500 before they are eligible for an advance. On the other hand, the maximum amount employees can apply for is 50% of their net monthly salary.

Please note that these minimum and maximum amounts are set to ensure fair and responsible usage of Kanz PaydayNow, allowing employees to access a portion of their earned wages while maintaining a balance between financial flexibility and responsible financial management.

We hope this FAQ provides a comprehensive understanding of Kanz PaydayNow. For further assistance, please reach out to our customer support team.