The Rise Indonesian Islamic Finance Industry

Islamic finance is a growing industry in Indonesia, with Shariah Finance assets reaching Rp 2,375 trillion as of December 2022. The Indonesian Financial Services Authority (OJK) has reported a 15.87% increase in Shariah finance assets from the previous year, and the country ranks third in the 2022 Islamic Finance Indicator (IFDI). However, the OJK warns that Indonesia must improve literacy and inclusion for Shariah finance to reach its full potential.

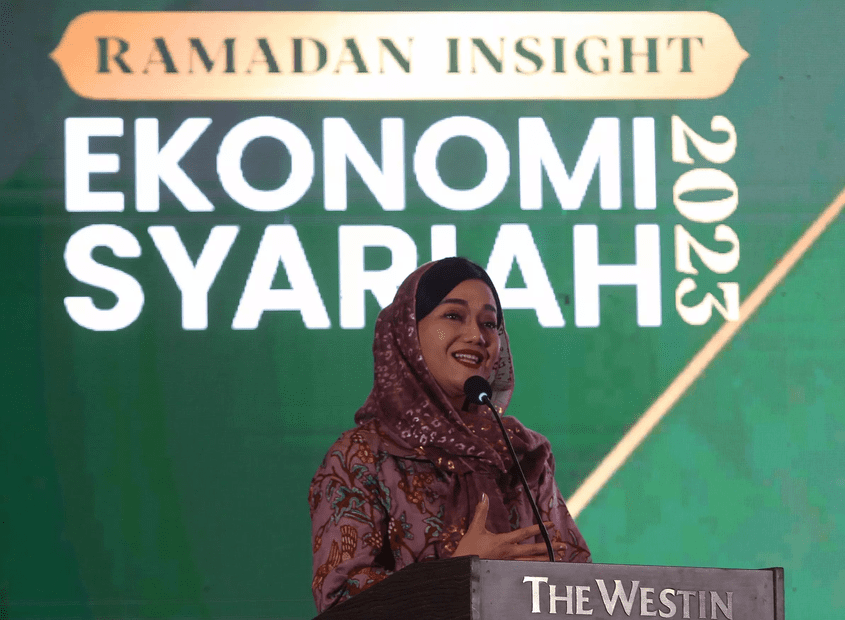

At the 2023 Ramadan Insight Forum: Shariah Economy in Jakarta, Friderica Widyasari Dewi, head for consumer protection at the OJK, highlighted the importance of Shariah products in the country. Dewi emphasized that Shariah products are not only for Muslims but for everyone and that using Shariah products brings governance benefits. Non-Muslims in Indonesia have also begun to use Shariah finance products.

The Shariah financial literacy index stood at 9.1% in 2022, while the Shariah financial inclusion index only reached 12.1%. This indicates a significant gap in Indonesia’s Shariah finance ecosystem, but the OJK remains optimistic that there is still a huge room for growth. The OJK plans to launch a master plan on financial literacy and inclusion index development, which will also include Shariah finance.

Competing with conventional banks, Bank Syariah Indonesia (BSI) represents 56.59% of the Indonesian Shariah banking market share as of November 2022. BSI has 1,101 branches, placing it in the top five Indonesian banks with the most branches, along with conventional giants such as BRI and BCA. However, Shariah financial banks must come up with innovations to provide services and pricing that are as good as conventional banks, according to Ade Cahyo Nugroho, director for finance and strategy at BSI.

The growth of Islamic finance in Indonesia presents an opportunity for the country to become the world’s largest center for the Shariah economy. However, Indonesia must ensure that it does not miss out on this momentum and work on improving literacy and inclusion for Shariah finance. With the launch of a master plan on financial literacy and inclusion index development, the OJK is optimistic that the Shariah economy will continue to grow under its supervision.

To understand more about this topic, continue reading it here: https://jakartaglobe.id/business/sharia-finance-is-on-the-rise-in-indonesia